Non-cash Items Are ______ That ____ Cash Flow.

The first step to bridge from earnings to cash flow is to neutralize non-cash items. Prepaid expenses Depreciation expense - Cash Cash Equivalents.

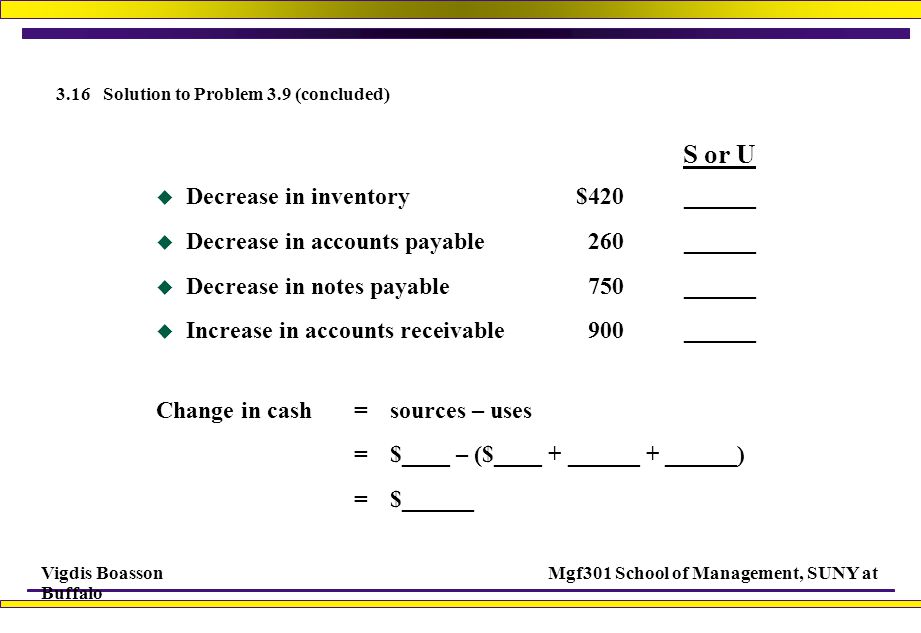

Sources And Uses Of Funds Statement Aka Cash Flow Statement

Gain on sale of fixed assets Equity in earnings of affiliated companies.

. Treatment of Non-Cash Items. Non-cash items do not affect. Total assets minus total liabilities b.

Examples of cash flows from operating activities are. Non-cash transactions are investing and financing-related transactions that do not involve the use of cash or a cash equivalent. The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense reduces profit but does not impact cash flow it is a non-cash expense.

An organization incurs non-cash expenses against balance sheet non-cash items. Hence it is added back. Similarly if the starting point profit is above interest and tax in the income statement then.

Current liabilities minus current assets. However some non-cash investing and financing activities may be much important for the users of financial statements because they may have a significant impact on the current and future performance in terms of revenues profits and the. While they may not impact the net cash flow of the business these expenses impact the bottom-line of the income statement and result in lower reported earnings.

In accounting noncash items are financial items such as depreciation and amortization that are included in the business net income but which do not affect the cash flow. The short run is a period when there are _____ costs. Both the financing flows due to cash transactions and those that are non-cash such as new finance leases need to be identified.

Examples of other effective flows New capitalised leases are not the only non-cash transaction for which adjustment may be required to obtain relevant cash flow sub-totals. According to GAAP when is income reported. Theory Non-Cash Items not included.

Like debtors is the money of the business that is owned by the company but has not been received. Net working capital equals _____. Non-Cash Item Example Depreciation and amortization are the two most common examples of noncash items.

Non-cash items do not affect. Well learn how to treat non-cash items in this lesson. Earnings per share c.

Hence it becomes vital to regulate the amount of net profit and loss as depicted by a statement of profit and loss for landing at cash flows from operating activities. Non-cash items are _____ that ____ cash flow. Changes in working capital Working capital represents the difference between a companys current assets and.

Were gonna go through a list of non cash items first and see if you can recognize a trend in these and why we might be linking them to a statement of cash flows discussion then we will explain more fully on the idea of looking at non cash items when considering a statement of cash flows. Reviewed by Dheeraj Vaidya CFA FRM. The exclusion of non-cash transactions from the cash flow statement is consistent with the objective of a cash flow statement as these items do into involve cash flows in the current period.

These non-cash items are charged as expenses in the income statement. So some examples of non cash items would be the purchase of long term. Current assets minus current liabilities c.

What are non-cash transactions on the cash flow statement. Do not directly affect. Examples of non-operating cash flow can include taking.

A non-cash item is an entry on an income statement or cash flow statement correlating to expenses that are essentially just accounting entries rather than actual movements of cash. When it is earned or accrued. Net income is adjusted in the Cash Flow from Operations section of the cash flow adding back to net income all non-cash charges and subtracting all non-cash income.

However we add this back into the cash flow statement to adjust net income because these are non-cash expenses. It involves non-operating items such as profit and loss on the sale of fixed assets interest paid etc. Non-cash items on a companys financial statement to develop the statement of cash flows.

In financial accounting a Cash Flow Statement also known as Statement of Cash Flow is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents and breaks the analysis down to operating investing and financing activities. In other words no cash transactions are involved. Non-operating cash flow is comprised of the cash a company takes in and pays out that comes from sources other than its day-to-day operations.

Non-cash expense is a charge against earnings of the company which does not involve cash outflow. View Cash flow final notesdocx from LAW 200111 at Western Sydney University. The last item or bottom line on the income statement is typically the _____ net income.

Essentially the cash flow statement is concerned with the. For example on the income statement but it is a non-cash item. Non-cash items such as goodwill to be written-off depreciation etc.

There are many types to watch out for but the most common examples include. Accrued charges Non-cash incomes are. List of the Most Common Non-Cash Expenses.

What is a Non-Cash Item. When a company buys an asset or incurs an expense but instead of using cash writes a promissory note or takes over an existing loan the company is involved in a non. Non-Cash Expense refers to those expenses which are reported in the income statement of the company for the period under consideration but does not have any relation with the cash ie they are not paid in the cash by the company and includes expenses like depreciation etc.

Add back non-cash expenses and subtract out non-cash incomes. Article by Sayantan Mukhopadhyay. As you can see the 500 depreciation expense is actually a non-cash item and the capital cost is recorded only once on the cash flow statement.

• other non-cash items IAS 7 Statement of Cash Flows. Statement of cash flows reports only those operating investing and financing activities that affect cash or cash equivalents.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_to_the_Firm_FCFF_Sep_2020-01-f5a6d0cd933447618490bce0f60b57d1.jpg)

Free Cash Flow To The Firm Fcff Definition

Acc1 14 The Statement Of Cash Flows 2 Flashcards Quizlet

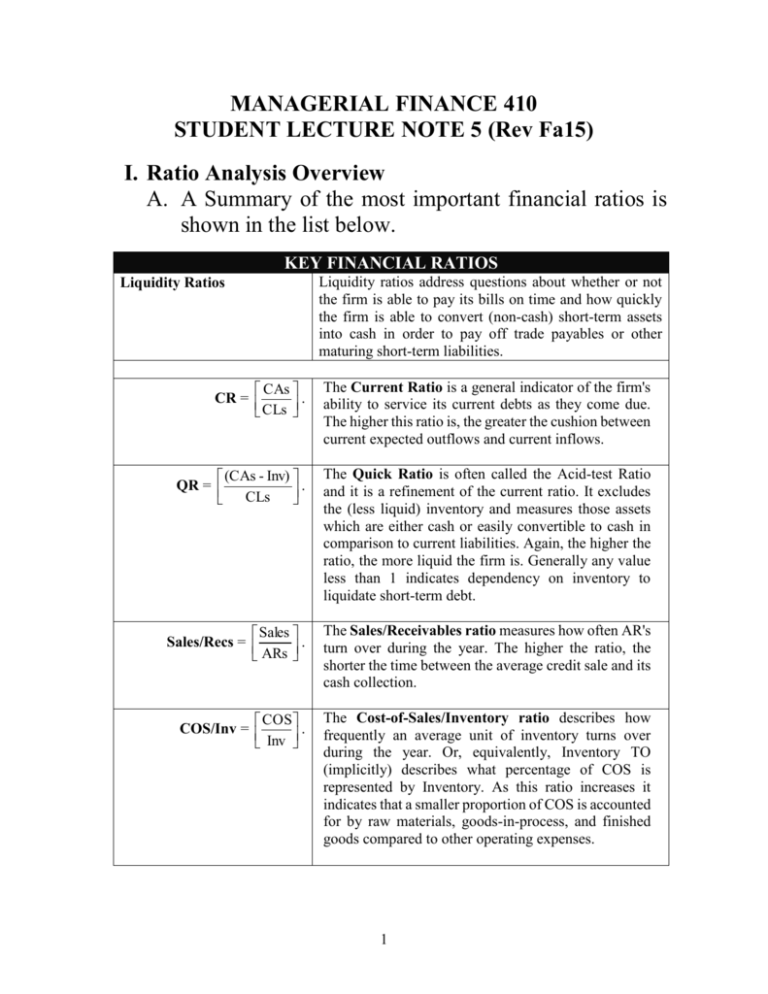

1 Financial Statements Cash Flows And Taxes

Fra Cash Flow Statements Flashcards Quizlet

Statistics And Risk Management Money Flow

Chapter 4 Ge Chapter 4 Ge M Dv Mkmf Vkkjv Kj Evk Kmfd Kjvfkj Kjv Kj Dvk Kf Ekvk Dkfj Vkjwdnckj Studocu

Ch 11 Act 210 Flashcards Quizlet

What Are Noncash Expenses Meaning And Types

Solutions Accounting Finance Student Association

Chapter 3 Working With Financial Statements Ppt Video Online Download

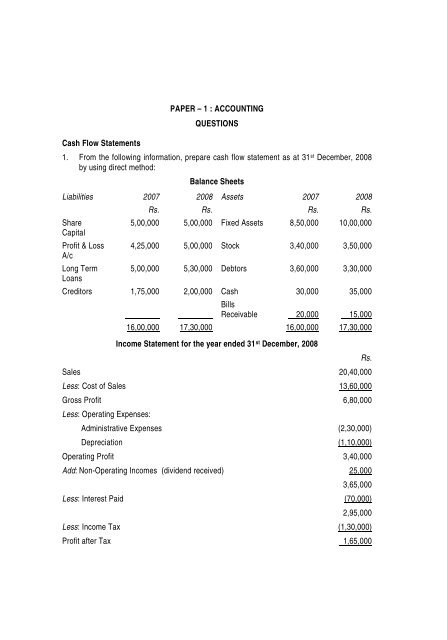

Paper 1 Accounting Questions Cash Flow Statements 1

Fra Cash Flow Statements Flashcards Quizlet

Fra Cash Flow Statements Flashcards Quizlet

Accounting Chapter 6 6 2 Inventory Methods And Financial Effects Flashcards Practice Test Quizlet

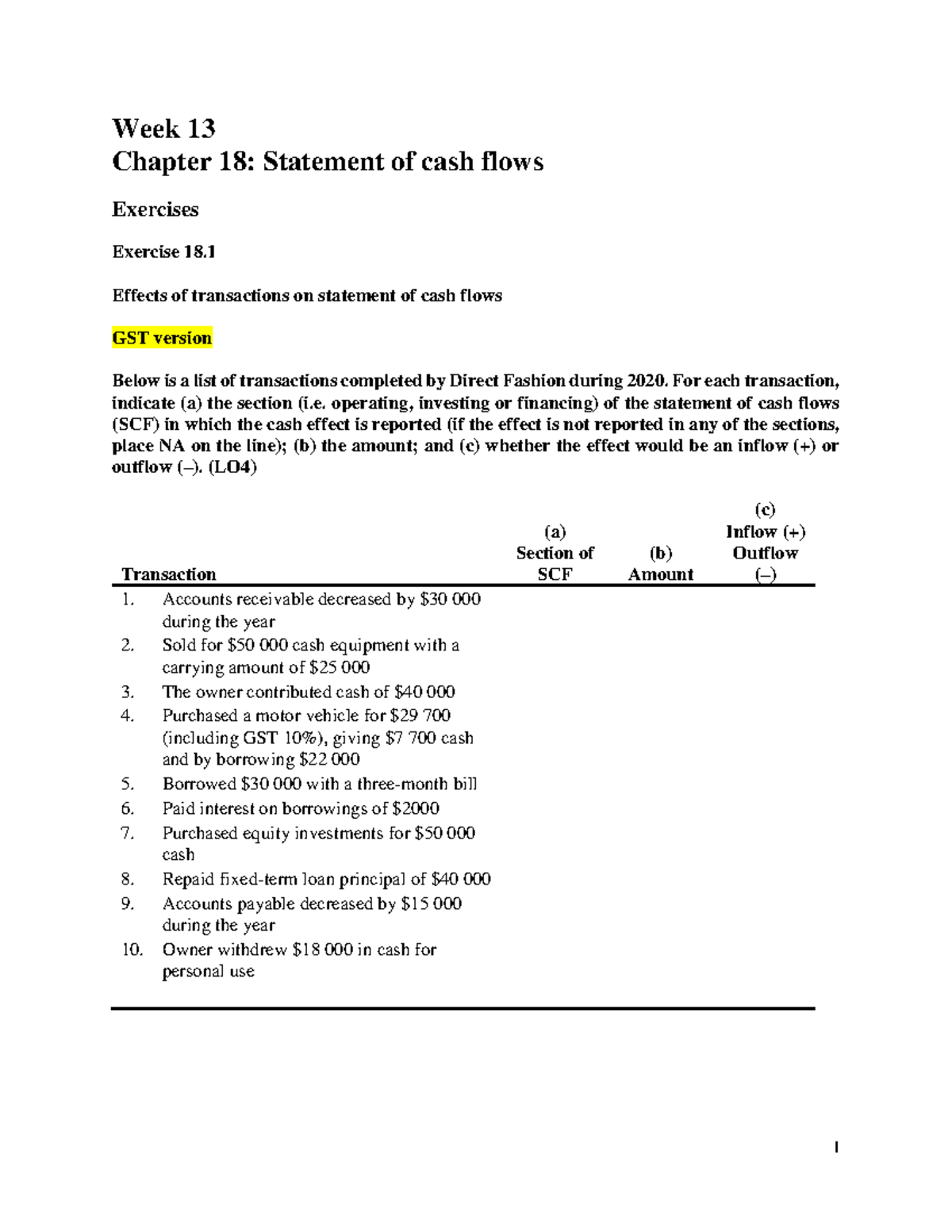

Week 13 Chapter 18 Cash Flow Statements Questions Warning Tt Undefined Function 32 Week 13 Studocu

Comments

Post a Comment